SanKash helps BNPL/consumer financing providers to plug and access its 6000+ merchants’ base network, aggregating $20 billion of transaction value through a single pay later button

SanKash, the fastest growing AI-powered platform which aggregates BNPL & consumer financing providers, today announced its partnership with EarlySalary and Finzy to offer Travel Now Pay Later (TNPL) option to Indian travelers. This move is to streamline the booking processes and avoid costly upfront investments for trips booked months in advance.

As a travel-first BNPL aggregator, SanKash helps BNPL/consumer financing providers to plug and access its 6000+ merchants’ base network, aggregating $20 billion of transaction value through a single pay later button. Sankash connects travel merchants and BNPL providers, as a middle layer, in a hassle-free way on a single interface to offer the best point-of-sale financing option to travelers.

SanKash AI powered engine does all the heavy lifting for customers & merchants. Basis Knock-off criteria set by NBFC, customer inputs, and travel data of customers, the engine decides the financial provider which is going to approve the case and the customer will only interact with one BNPL provider.

“Our partnership with EarlySalary and Finzy is another attempt on our part to create a new generation of credit by providing transparent and flexible payment options to the travelers. With the travel industry picking up again post-pandemic, we hope to provide a further boost by removing financial boundaries for travelers, through our financing partners. With outbound travel predicted to hit 29m by 2025, this is just the tip of the iceberg,” said Akash Dahiya, Co-founder and CEO SanKash.

Mr. Amol Maheshwari, Chief Distribution Officer, EarlySalary said, “We are excited to partner with the Leading Travel Aggregator, Sankash who provides Buy Now Pay Later (BNPL) solutions to Travelers. This partnership will enable us to power the affordability and aspirations of million Indians who wish to travel to their dream destinations every year. We have already processed BNPL transactions worth Rs. 2 crores seamlessly in the first 10 days of going live with SanKash. Post the third wave of COVID-19, Indians are looking forward to the much-needed holiday break with their families. Hence with the travel industry bouncing back, our partnership with SanKash will empower customers to plan their travel immediately and afford it in easy EMIs. Through this, we wish to enhance the happiness quotient & the aspirations of customers and significantly drive their confidence in seamless digital transactions.”

Speaking about the partnership, Vishwas Dixit, Co-founder & CMO from Finzy further said, “We are delighted to partner with SanKash to expand our offerings in the travel industry. SanKash is helping us in connecting with travel customers through their merchant tie-ups to offer the best point-of-sale financing option to the travelers. We digitally connect investors to hand-picked borrowers to provide risk optimized returns through SanKash.”

Since its launch in 2018, SanKash has focused on building a best-in-class product around its audience and their purchasing habits; seeing demand and customer loyalty solidify in the process. As SanKash continues to expand and onboard other lenders for their growing network of Airlines, Cruise liner, hotels, OTA’s, and other travel-related services, it can now easily and effortlessly provide travel merchants an opportunity to provide simple installments to customers that are customized to their unique financial needs in just seconds directly on the website, at the time of purchase.

(Disclaimer: The above press release comes to you under an arrangement with PRNewswire India and this publication takes no editorial responsibility for the same)

Borosil unveils the superb stainless steel lunch box set ‘Desh ka Dabba” for rural India

Borosil unveils the superb stainless steel lunch box set ‘Desh ka Dabba” for rural India  Fine Acers Hosted Investors Meet in Delhi

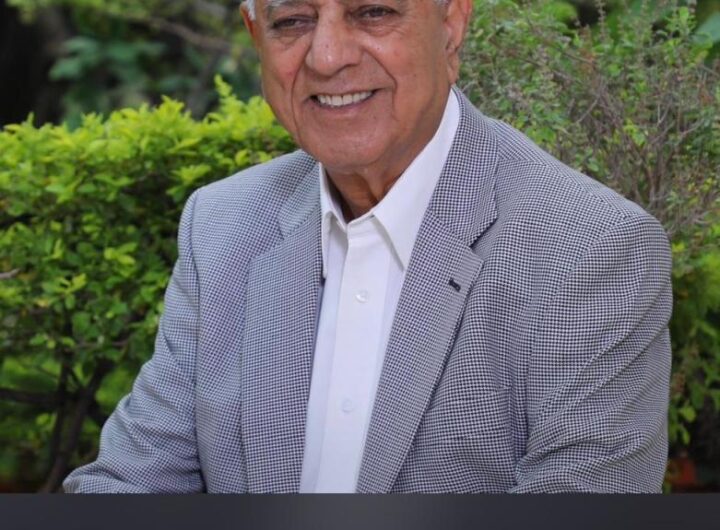

Fine Acers Hosted Investors Meet in Delhi  Founder of India’s Largest Coca-Cola Bottler SLMG Beverages, Shri S. N. Ladhani Passes Away at 85,Leaves Behind a Legacy of Inspiration

Founder of India’s Largest Coca-Cola Bottler SLMG Beverages, Shri S. N. Ladhani Passes Away at 85,Leaves Behind a Legacy of Inspiration  Jesus Calls Prayer Festival in Tirunelveli

Jesus Calls Prayer Festival in Tirunelveli  Tata Gluco+ Jelly Joins Forces with Disney’s Marvel Avengers

Tata Gluco+ Jelly Joins Forces with Disney’s Marvel Avengers  Airtel Business launches “Business Name Display” (BND) for enterprises

Airtel Business launches “Business Name Display” (BND) for enterprises