Paytm Partners with SBI Mutual Fund to Launch JanNivesh ₹250 SIP, Contributing to Viksit Bharat Vision and Enabling Everyone to Start Investing {business]

- Offers flexible SIP options (daily, weekly, or monthly) for young professionals and first-time investors looking for adaptable investment opportunities

- Aims to empower merchant partners to make their first investment, helping them build long-term wealth for their business

- Paytm pioneered QR code payments in India, driving the shift to mobile payments – now, it aims to bring the same transformation to the investment sector

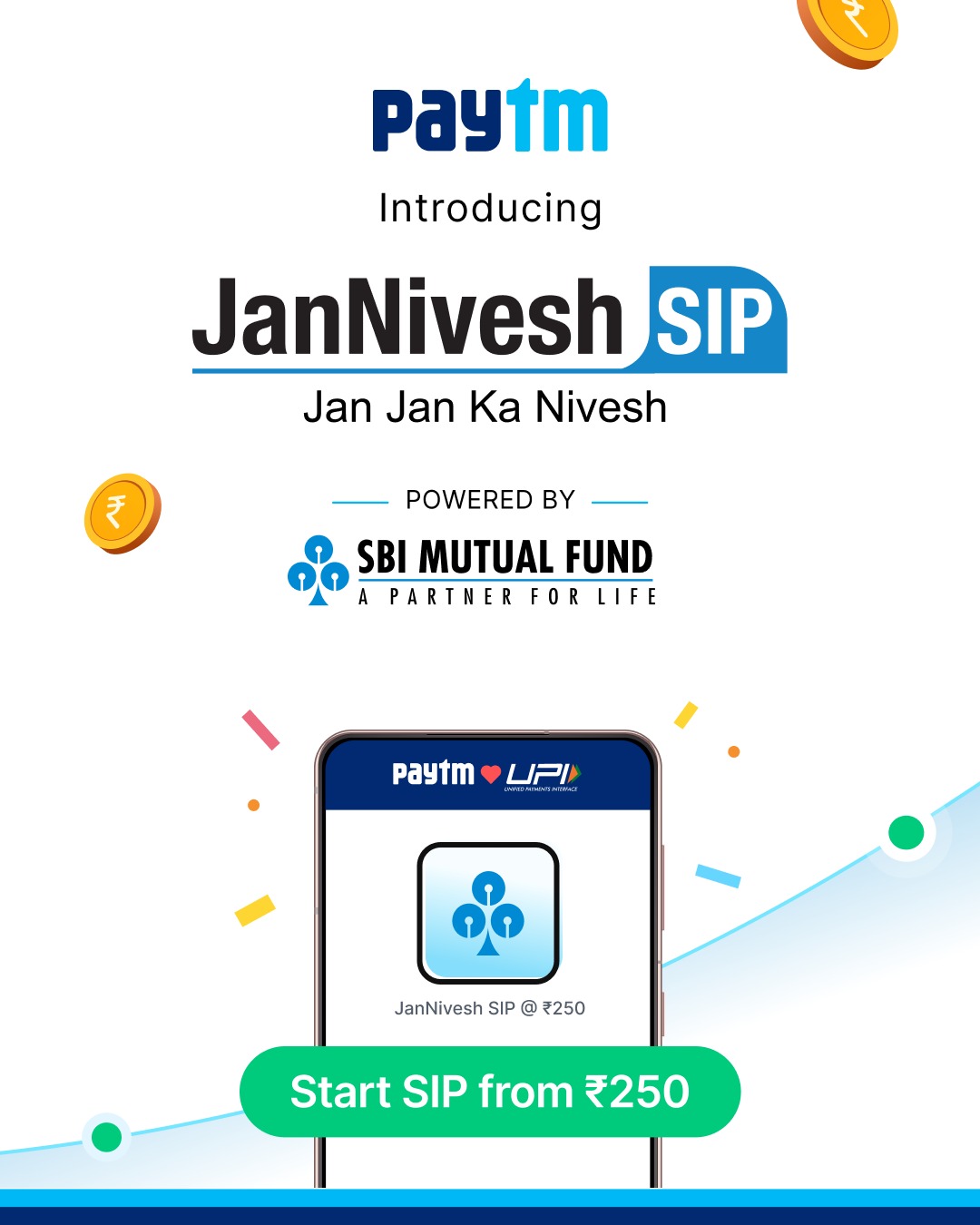

Paytm (One97 Communications Limited), India’s leading payments and financial services distribution company and pioneer of QR codes, Soundbox, and mobile payments, has announced that its wholly owned subsidiary, Paytm Services Private Limited (PSPL), an AMFI registered mutual fund distributor, ARN-114595, is now making it easier for millions of Indians to invest in their future. In partnership with SBI Mutual Fund, India’s largest asset management company, Paytm has launched the JanNivesh ₹250 SIP, in line with the Government of India’s vision for a Viksit Bharat by enabling financial inclusion and empowering citizens to invest in their future. This initiative, launched today by SEBI Chairperson Smt. Madhabi Puri Buch and SBI Chairman Shri C S Shetty, enables users to begin their investment journey with just ₹250, making financial growth accessible to all.

The JanNivesh SIP initiative is aimed at empowering citizens to contribute towards India’s financial and economic growth. It offers individuals a simple, affordable entry into wealth-building through small, regular investments, facilitating participation in key financial instruments with just ₹250. Additionally, it provides flexible SIP options – daily, monthly, or weekly contributions – to suit varied financial needs and preferences. This step is pivotal in encouraging financial literacy, economic inclusion, and supporting the Viksit Bharat journey.

The company aims to empower Paytm's merchant partners by offering them the opportunity to make their first investment, helping them build long-term wealth for their business. This initiative is designed to improve their financial stability and contribute to the broader vision of financial inclusion and economic empowerment. Paytm is committed to supporting the growth of its merchant partners and strengthening the financial foundation of their businesses.

D.P Singh, DMD & Joint CEO, SBI Mutual Fund said, “We have launched the JanNivesh ₹250 SIP, a key initiative that brings us closer to our goal of promoting financial inclusion. Through our partnership with Paytm and other Fintech players, we are offering millions of Indians an easy and flexible entry point to begin investing in their future. This is an important step in our shared vision for a Viksit Bharat, where every citizen has access to wealth-building opportunities.”

Vijay Shekhar Sharma, Founder & CEO – Paytm said, “We are excited to participate in the Government of India’s Viksit Bharat vision with the launch of JanNivesh ₹250 SIP on Paytm, in partnership with SBI Mutual Fund. The mutual funds market currently has over 100 million investors, and we are thrilled to be part of the journey towards expanding this to 300-400 million mutual fund investors. This initiative, with its simple and low-investment amount SIP options, allows millions of Indians to start investing and contribute to the nation’s economic growth. We extend our gratitude to SBI and SEBI for making this vision a reality.”

How to Set Up Your JanNivesh SIP on Paytm:

- Open the Paytm App and tap on the JanNivesh SIP icon in the 'Do More with Paytm' section.

- Choose your preferred investment frequency—Daily, Weekly, or Monthly.

- Select the investment amount, starting from ₹250, that you wish to contribute towards your SIP.

- Click on “Proceed” and enter your PAN details when prompted.

- Complete your SEBI-mandated KYC steps by providing the required details.

- Review your SIP details and proceed to set up UPI Autopay mandate for seamless payments.

- Once the UPI Autopay mandate is successfully set up, your SIP will be registered.

Your investments will then be processed automatically based on your selected frequency. This streamlined process ensures a hassle-free way to invest and grow your wealth with JanNivesh SIP on Paytm!

Paytm’s collaboration with JanNivesh ₹250 SIP is set to transform India’s investment landscape, driving financial inclusion and contributing to the nation’s economic growth. Just as Paytm pioneered QR code mobile payments and revolutionized the payment sector, it now aims to bring the same level of innovation to the investment space. This initiative aligns with the government’s Viksit Bharat vision, offering millions of Indians an accessible, affordable way to start investing and contribute to India’s future prosperity.