MUMBAI, India, Feb. 9, 2021 /PRNewswire/ — Board of Paisalo Digital approved the issue of 2.61 million equity warrants on preferential basis to promoter group that shall be converted into equivalent number of equity shares, this shall increase the shareholding of promoters by approximately 5% of post issue capital.

The company signed the first co-lending arrangement in the country and primarily focuses on small ticket size income generation priority sector loans. Paisalo Digital has entered this co-lending arrangement with India’s largest PSU bank, wherein it would originate and process loans with its proprietary credit algorithm under its income generation loans extended to both individuals and group lending schemes, of which 80% would be funded by the PSU bank and the balance would be funded by Paisalo Digital. The company would manage the loan including collections and would earn a fee on the AUM. This arrangement positions PAISALO at the forefront of Digital Transformation of lending sector happening in India as well as contribute to Government of India’s Financial Inclusion and Atmanirbhar Bharat Plan.

Incorporated in 1992, Paisalo Digital is registered with the Reserve Bank of India (RBI) as a non-deposit taking systemically important non-banking finance company (ND-SI-NBFC).

About Paisalo Digital Limited:

Paisalo Digital Limited (BSE: PAISALO) (NSE: PAISALO) (BLOOMBERG: PAISALO.IN) (ISIN: INE420C01042) is a leading Systemically Important Non-Deposit taking NBFC registered with the Reserve Bank of India, in operation since 1992. The company was founded by Mr. Sunil Agarwal, who possesses a rich experience of 27 years in the small finance business and is holding the position of Managing Director of the Company since 1992. His experience, efforts and active involvement in the business operations have ensured that PAISALO has grown to be a listed, well governed NBFC with footprints in rural and semi urban areas in India. The company’s main thrust is on small finance to ensure rural development, self-employment and women-empowerment. The small credit division offers loans from INR 10,000 to 1,00,000 through the Individual and Community lending model providing unsecured loans to entrepreneurs under Priority Sector Lending.

For more information about the company please visit: www.paisalo.in

(Disclaimer: The above press release comes to you under an arrangement with PR Newswire India and this publication takes no editorial responsibility for the same.)

Hinduja Foundation and Ambuja Foundation’s water conservation efforts transform 2.74 lakh lives in Rajasthan

Hinduja Foundation and Ambuja Foundation’s water conservation efforts transform 2.74 lakh lives in Rajasthan  Choice Consultancy Services Secures Landmark Projects Worth ₹63.47 Crores across Maharashtra and Odisha

Choice Consultancy Services Secures Landmark Projects Worth ₹63.47 Crores across Maharashtra and Odisha  Australia’s Deputy Prime Minister leads education forum at University of Melbourne’s Global Centre in Delhi

Australia’s Deputy Prime Minister leads education forum at University of Melbourne’s Global Centre in Delhi  Vietjet Unveils 6.6 Flash Sale: Enjoy 66% Off Eco Tickets for One Day Only

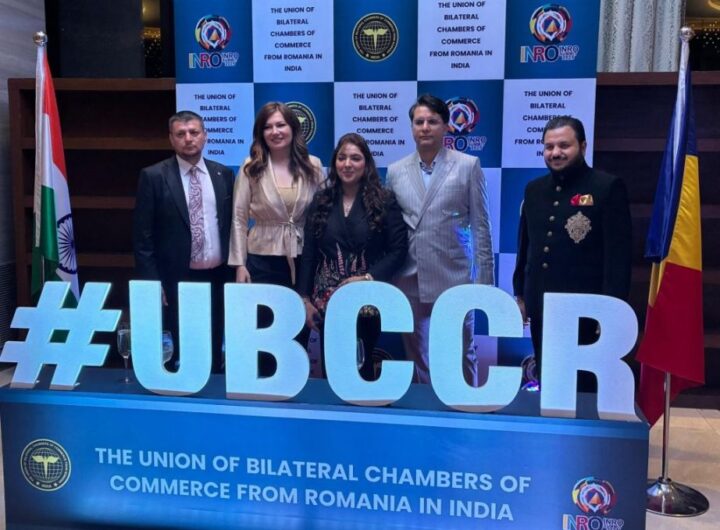

Vietjet Unveils 6.6 Flash Sale: Enjoy 66% Off Eco Tickets for One Day Only  INRO Business Summit 2025 Sets the Stage for a New Era of Indo-Romanian Economic Coperation

INRO Business Summit 2025 Sets the Stage for a New Era of Indo-Romanian Economic Coperation  Aster Prime Hospital Staff Plant 200 Saplings on World Environment Day

Aster Prime Hospital Staff Plant 200 Saplings on World Environment Day