MUMBAI, India, Feb. 27, 2023 /PRNewswire/ — Della Adventure and Resorts Pvt. Ltd, which owns and manages the popular Della Resorts and Della Adventure Park in Lonavala, has raised Rs 208 crores in non-convertible debentures (NCDs) are to be utilized to part-refinance debt, while giving impetus to the expansion endeavours of the group's hospitality arm. The financing was led by Nomura, a global financial services group. A wholly-owned subsidiary of the Della Group, Della Resorts is valued at Rs 660 crores as per a valuation done by Mandeep Lamba, President South Asia and his team of hospitality consultants HVS Anarock.

Jimmy Mistry, Chairman and Managing Director, Della Group has said, “The proceeds from the NCDs will be utilised partly to refinance existing debt and towards the expansion strategy of our hospitality arm. Della Resorts will soon foray into increasing its current inventory while transforming into a 300-key resort

Singapore-based Vishal Sharma, who led the transaction for Nomura, said, “We are excited about this partnership and wish Jimmy and Della a bright and successful future. We are invested in India, and it's becoming a core market for us. We will also continue to look at and evaluate various other investing opportunities.”

Alpha Investment Capital, a Dubai-based Financial and Business Consultancy headed by ex-ICICI Middle East CEO Murugan Shankaran were driving the project as Transaction Advisors. The legalities were overseen by legal honchos Satish Kishandani of Pioneer Legal and Rituparno Bhattacharya of TT&A.

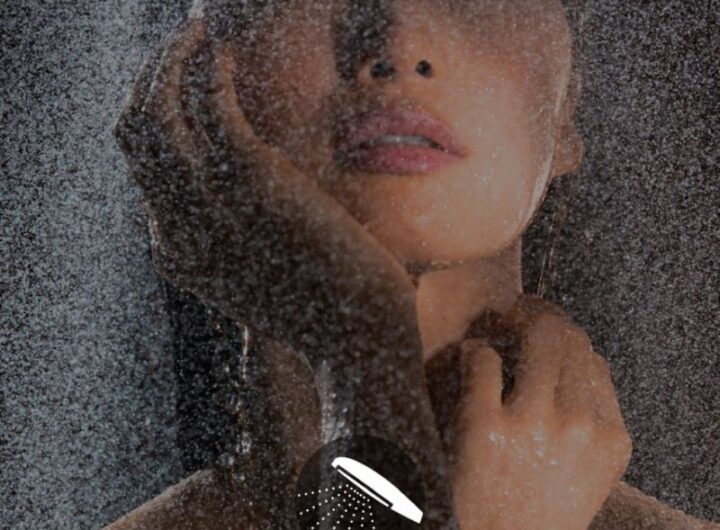

TOTO India Introduces New Variant of shower – Mist Spa, Enhancing Daily Wellness with Advanced Microbubble Technology

TOTO India Introduces New Variant of shower – Mist Spa, Enhancing Daily Wellness with Advanced Microbubble Technology  IEL HR reports 39% Growth in Revenues and harnesses deep tech for its HR Tech Platforms

IEL HR reports 39% Growth in Revenues and harnesses deep tech for its HR Tech Platforms  Canara HSBC Life Insurance Declares ₹250 Crore Bonusfor FY 2025

Canara HSBC Life Insurance Declares ₹250 Crore Bonusfor FY 2025  JSW One posts record growth, becomes India’s largest steel-selling platform

JSW One posts record growth, becomes India’s largest steel-selling platform  Airtel introduces India’s First All-in-One OTT Entertainment Packs for Prepaid Users

Airtel introduces India’s First All-in-One OTT Entertainment Packs for Prepaid Users