Gold loan book for DBS Bank India increased 26% in 2023 over previous year, leveraging bank’s ‘phygital’ strategy

DBS Bank Indiahas enhanced its offering -DBS Gold Loans – by introducing a range of value-added features in line with its aim to be the ‘Gold Standard in Gold Loans’.The Bank has witnessed encouraging growth in its gold loans businessfueled by its expanded network of ~530 branches across 350+ locations, superior customer experience andheightened demand from the agrarian community, primarily in South India.

DBS Gold Loans offer seamless and hassle-free financing for personal and business expenses and are a core part of the Bank’s diversified lending portfolio.The Bank is reimagining the gold loan customer experienceto welcomea diverse client base, including salaried professionals, self-employed individuals, and small business owners.Customers can easily access DBS Gold Loansby pledging their gold ornamentsand be empowered withattractive interest rates and a promise of premium servicestandards. In contrast to traditionalchannels, whichare often associated with a lack of transparency, DBS prides itself on a trustworthy experience, having been recognised as the 'Safest Bank in Asia' by Global Finance for 14 consecutive years (2009-2022). The Bank has introduced a balance transfer feature, which allows customers to transfer their existing outstanding loan balance from other financial institutionsto DBS Bank India, resulting in savings on interest rates and processing fees.

Currently, DBS Bank India's gold loan book has crossed ₹6300 crores, and the Bank is planning to more than double this figure within the next five years.DBS Gold Loans are designed to meet individual goals, but flexible enough to be tailored for evolving business requirementslike managing working capital needs or purchasing equipment and machinery. The goal to bethe ‘Gold Standard in Gold Loans’ is derived from the unique benefits offeredby DBS such aspersonalised customer service, speedy loan disbursal within 30 minutes*, higher loan amounts per gram of gold and the Bank’sglobal standards of safety.The loan quantum ranges from a minimum of INR 25,001 to a maximum of INR 50 lakhs per customer, with competitive interest rates.

Commenting on the new features, Sajish Pillai, MD & Head – Assets and Strategic Alliances, Consumer Banking Group, DBS Bank India said, “We are witnessing exciting trends in the gold loan sector in India and have evolved ouroffering to cater to a wider audience that could be younger, more urban or more digitally savvy and rightly expects more from their lender.DBS Gold Loansempower individuals and businesses to unlock the true value of their gold assets. We cater to a wide range of financial needs, be it urgent requirements or short-term liquidity solutions for businesses, offering quick disbursal and competitive interest rates. Our robust branch footprint and extensive experience in serving customers in this segment makes DBS Bank India the trusted partner for gold loans. With a compelling product proposition and rising demand in the market, we are well-positioned togrow this offering significantly in the next few years.”

DBS Bank India hadrun a 360-degree campaign around these new features throughout August 2023. Through the campaign film, the Bank encourages customers to take the gold loan test and choose the option that truly embodies the Gold Standard – DBS Gold Loans. The month-long campaign was promoted through print, digital, radio, in-cinema, and outdoor channels in Tamil Nadu, Andhra Pradesh, Telangana, and Karnataka.

For more information about DBS Gold Loans please visit the website or contact your nearest DBS Bank India branch.

*Disbursal time is subject to verification and completion of all required documentation

Hinduja Foundation and Ambuja Foundation’s water conservation efforts transform 2.74 lakh lives in Rajasthan

Hinduja Foundation and Ambuja Foundation’s water conservation efforts transform 2.74 lakh lives in Rajasthan  Choice Consultancy Services Secures Landmark Projects Worth ₹63.47 Crores across Maharashtra and Odisha

Choice Consultancy Services Secures Landmark Projects Worth ₹63.47 Crores across Maharashtra and Odisha  Australia’s Deputy Prime Minister leads education forum at University of Melbourne’s Global Centre in Delhi

Australia’s Deputy Prime Minister leads education forum at University of Melbourne’s Global Centre in Delhi  Vietjet Unveils 6.6 Flash Sale: Enjoy 66% Off Eco Tickets for One Day Only

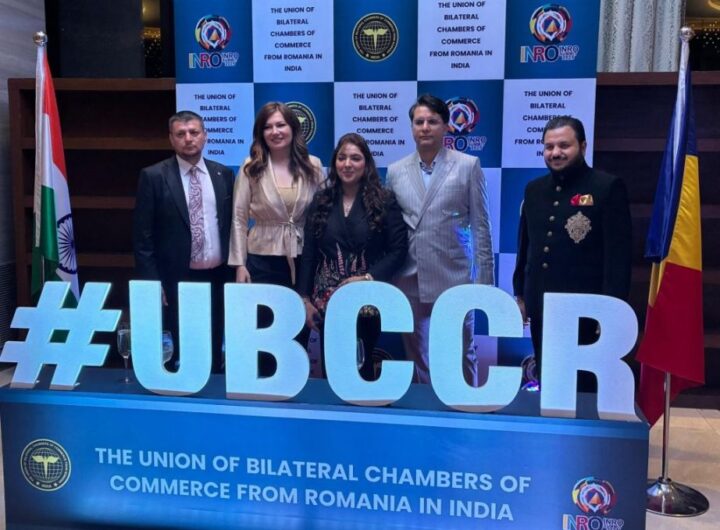

Vietjet Unveils 6.6 Flash Sale: Enjoy 66% Off Eco Tickets for One Day Only  INRO Business Summit 2025 Sets the Stage for a New Era of Indo-Romanian Economic Coperation

INRO Business Summit 2025 Sets the Stage for a New Era of Indo-Romanian Economic Coperation  Aster Prime Hospital Staff Plant 200 Saplings on World Environment Day

Aster Prime Hospital Staff Plant 200 Saplings on World Environment Day